A Set of Courses on

Blended Program (Self Paced + Live Interactive)

Blended Program (Self Paced + Live Interactive)

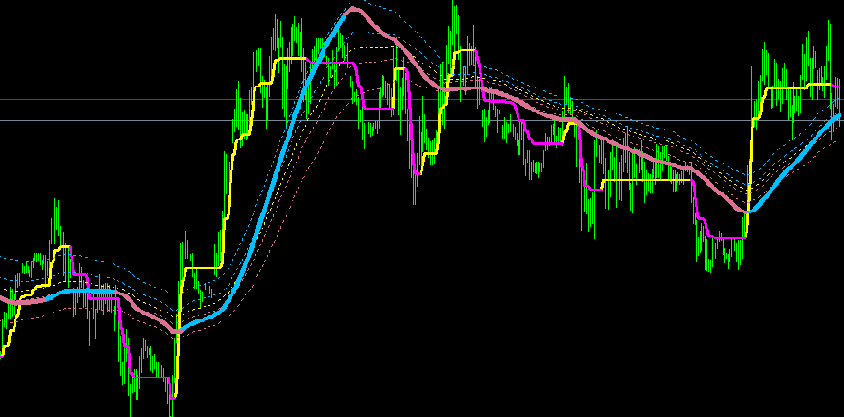

Technical Analysis and Chart Patterns for Capital Markets

Blended Program (Self Paced + Live Interactive)

Blended Program (Self Paced + Live Interactive)

- 10 Technical Analysis Strategies & 5 Certificate Courses

- 12 Live Interactive Sessions (2 Hours Monthly)

- 20+ Hours of Digital Content

- Access to content on Digital Platform

24 Hours of

Live Interactive

Sessions